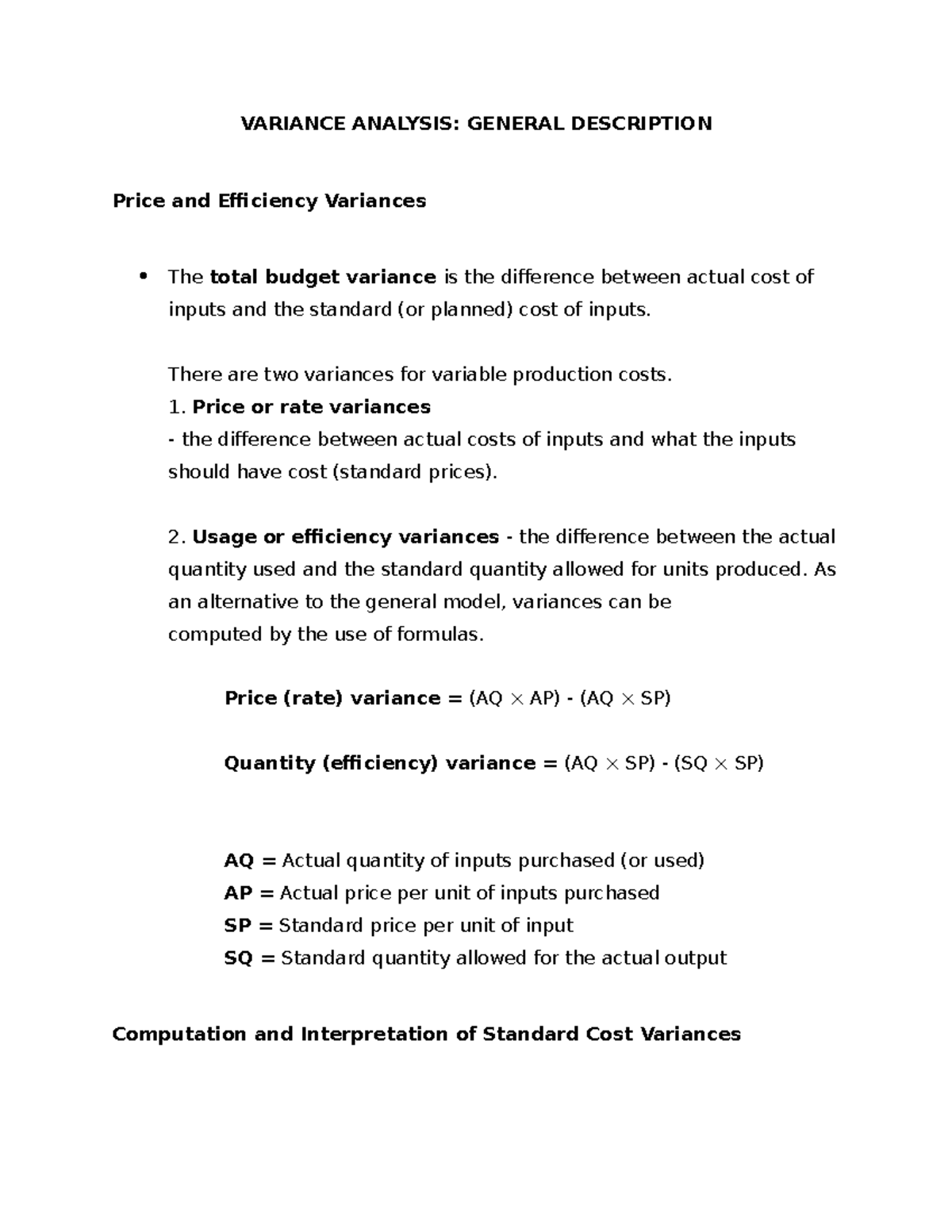

In this formula, divide what you actually spent or used by what you predicted. Then, subtract 1 and multiply the total by 100 to turn it into a percentage. If the number is negative, you have an unfavorable variance (don’t panic—you can analyze and improve). Forecasting how much you’re going to spend and receive is a key part of running a business. More than likely, you’ll experience a variance in accounting at some point. Standard costs are cost targets used to make financial projections and evaluate performance.

Video Illustration 8-4: Computing variable manufacturing overhead variances

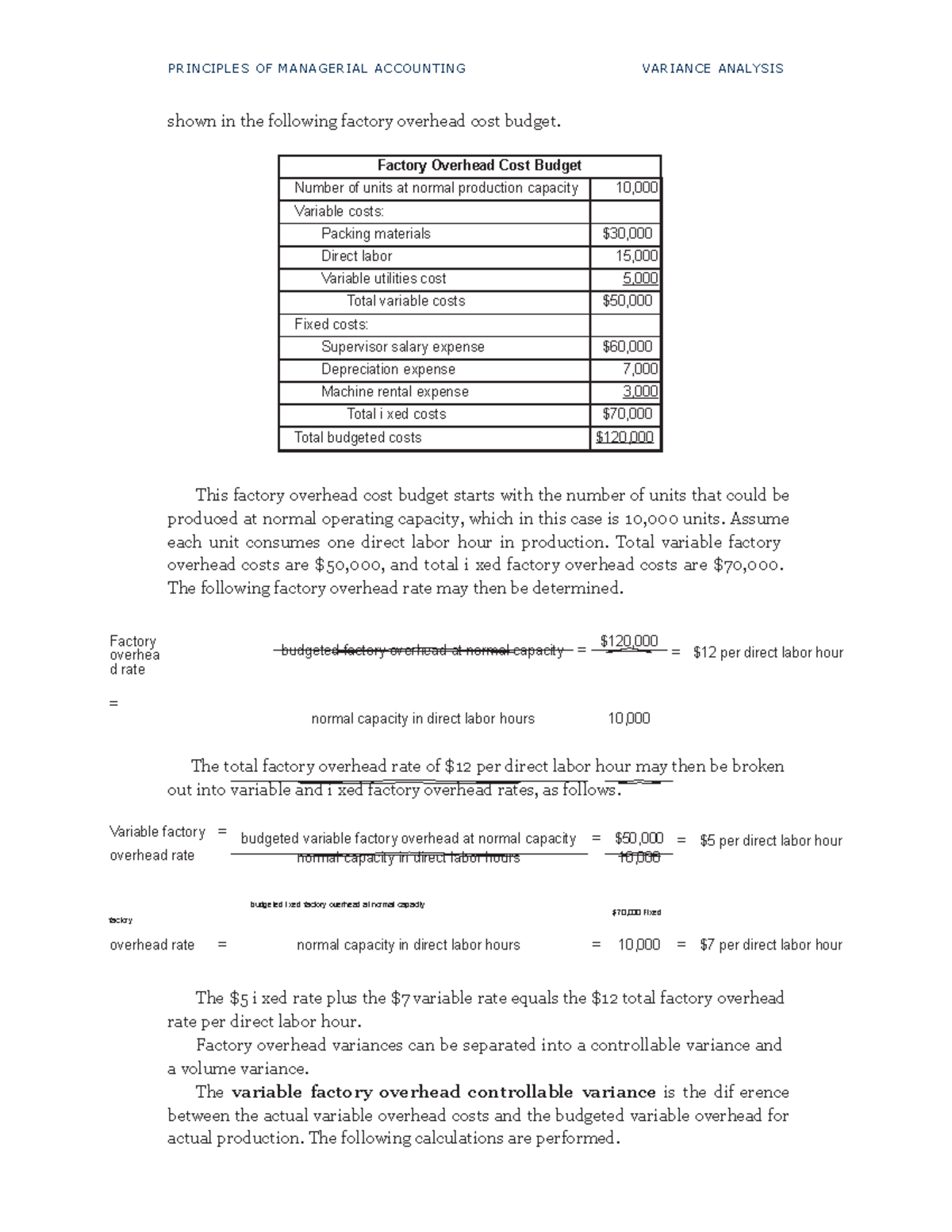

The standard overhead rate is the total budgeted overhead of \(\$10,000\) divided by the level of activity (direct labor hours) of \(2,000\) hours. Notice that fixed overhead remains constant at each of the production levels, but variable overhead changes based on unit output. If Connie’s Candy only produced at \(90\%\) capacity, for example, they should expect total overhead to be \(\$9,600\) and a standard overhead rate of \(\$5.33\) (rounded). If Connie’s Candy produced \(2,200\) units, they should expect total overhead to be \(\$10,400\) and a standard overhead rate of \(\$4.73\) (rounded). In addition to the total standard overhead rate, Connie’s Candy will want to know the variable overhead rates at each activity level. The logic for direct labor variances is very similar to that of direct material.

Would you prefer to work with a financial professional remotely or in-person?

It could mean that the direct materials quantity standard needs to be reduced to achieve an accurate standard variable cost per unit. Or, further investigation might reveal a production error in which the units were improperly sized, which is a significant quality control issue. Overall, Brad spent $15,000 more on direct materials than he projected. The following is a summary of all direct materials variances (Figure 8.6), direct labor variances (Figure 8.7), and overhead variances (Figure 8.8) presented as both formulas and tree diagrams.

The Role of Standards in Variance Analysis

It documents where things are going well and, more importantly, where they need improvement. This information can provide insight into what actions management accounting and functions should be taken to meet forecasted targets. This variance assesses the economy rather than the efficiency of the way an entity using its resources.

Determination of Variable Overhead Rate Variance

These include the size of the variance, the costs involved, historical trends, seasonal effects, calculation reliability, etc. The calculation helps determine whether the difference is within the acceptable variance in the accounting range. The acceptable variance in accounting standards or values is a set of universally accepted numbers in a given industry. Your variance is -50%, showing that your actual labor hours were 50% fewer than you predicted. Take a look at our examples to see both the amount and percentage for unfavorable and favorable variances. The direct material variances for NoTuggins are presented in Exhibit 8-4 below.

Fixed Factory Overhead Variances

Within the relevant range of production, fixed costs do not have a quantity standard, only a price standard. Fixed manufacturing overhead is analyzed by comparing the standard amount allowed to the actual amount incurred. Adding the two variables together, we get an overall variance of $4,800 (Unfavorable).

Fixed overhead, however, includes a volume variance and a budget variance. The fixed factory overhead variance represents the difference between the actual fixed overhead and the applied fixed overhead. One variance determines if too much or too little was spent on fixed overhead. The other variance computes whether or not actual production was above or below the expected production level. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. The standard overhead rate is calculated by dividing budgeted overhead at a given level of production (known as normal capacity) by the level of activity required for that particular level of production.

- In either case, managers potentially can help other managers and the company overall by noticing particular problem areas or by sharing knowledge that can improve variances.

- Brad sold 150,000 units of NoTuggins during the first year of operations.

- Finding specific variances can give you a more detailed view of your business’s performance and financial health.

To begin, recall that overhead has both variable and fixed components (unlike direct labor and direct material that are exclusively variable in nature). The variable components may consist of items like indirect material, indirect labor, and factory supplies. Fixed factory overhead might include rent, depreciation, insurance, maintenance, and so forth. As a result, variance analysis for overhead is split between variances related to variable overhead and variances related to fixed overhead. The total variances can be calculated in the last line of the top section of the template by subtracting the actual amounts from the standard amounts. The standard quantity allowed of 630,000 feet is subtracted from the actual quantity purchased and used of 600,000 feet, yielding a variance of 30,000 feet.

A cost driver, typically the production units, drives the variable component of manufacturing overhead. As with any variable cost, the per unit cost is constant, but the total cost depends on the quantity produced or another cost driver. The focus of this section is variable manufacturing overhead since it has both a quantity and price standard. This result is interpreted as the organization paid $30,000 more for materials used in production than they planned.

He conducts variance analysis as part of the various analyses executed to determine the company’s financial performance. He does this by identifying the causes of variances and taking the necessary action by comparing the actual incurred expenses and income with the projected numbers. If the resulting variance is positive, it signifies a favorable outcome, meaning the actual results exceeded expectations, such as lower costs or higher revenues.